After Almost a Decade, Greek Bonds Are Back on Traders’ Radars

- Needs to build out yield curve to lure investors: Commerzbank

- Country’s debt is still 180 percent of GDP; growth is positive

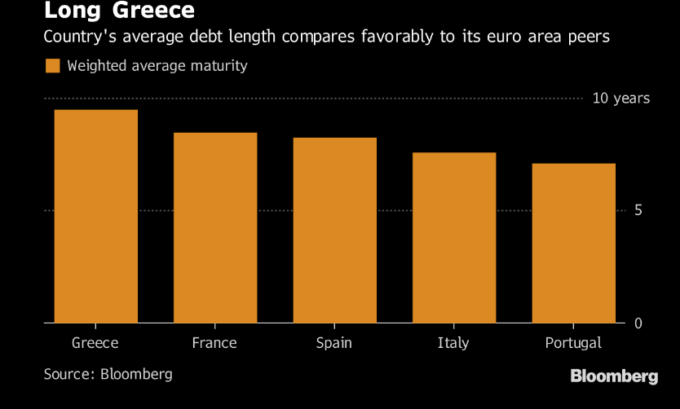

The longer debt profile means that “the risk emanating from a buyers’ strike forcing Greece’s hands — that’s very much limited,” Peter Schaffrik, global macro strategist at RBC Capital Markets, told Bloomberg Television. “At these yield levels it’s a decent investment.”

The yield on the nation’s 10-year bonds declined two basis points to 4.32 percent on Monday, a far cry from the near-40 percent levels seen before Greek debt held by private investors was restructured in March 2012.

Greece hasn’t held a bond auction since the start of the restructuring of its public finances, issuing debt only via syndication in recent years. Finance minister Euclid Tsakalotos has done a marketing tour through the world’s financial capitals in recent months amid speculation that Greece will announce this year a program for tapping the markets in 2019.

‘New Benchmark’

The nation could issue a new 10-year benchmark bond as soon as next month, according to Commerzbank AG head of fixed-rate strategy Christoph Rieger. While Greece has a 23-billion euro ($26.3 billion) cash buffer, which means financing needs aren’t urgent, building out the yield curve would help lay the groundwork to build up some investor support.

“After the five- and seven-year notes issued in 2017 and 2018, a new 10-year benchmark would be the next logical step,” Rieger said.

The stock of debt amounts to around 180 percent of economic output — much of which is owned by European creditors. The country has received 289 billion euros of rescue loans over the last eight years. It is currently ranked non-investment grade by major ratings agencies — meaning it is ineligible for the European Central Bank’s purchase program — although Fitch Ratings upgraded the nation to its highest level since 2011 on Aug. 10.

Now that the country has exited its bailout program, the country’s debt will no longer be eligible for use as collateral with the ECB, so domestic lenders will need to use investment-grade assets to gain access to zero-interest loans, according to Rabobank International Plc. Recent political risks emanating from Italy and trade tensions may also make it tough to find a time to return to the market this year.

“The country need to stick to the reform agenda and ensure that from the market’s perspective, the only volatility seen in Greek spreads is being externally, not internally driven,” said Matthew Cairns, a strategist at Rabobank.

The yield on Greek 10-year government bonds is currently at 4.32 percent, compared with a high of more than 44 percent in 2012 and having touched 3.65 percent in January. The recent risk aversion in markets have helped boost yields in recent months.

“They could come to the markets already, if they decided to do so, though naturally they would have to pay higher yields to compensate investors for the risks,” said Jan von Gerich, chief strategist at Nordea Bank AB. “From an investors perspective, Greek bonds at current levels would be attractive for many.”