Greek bonds as a safer bet? Now that’s something new.

While still ranked non-investment grade by major rating companies, the Mediterranean nation’s debt may prove relatively resilient to simmering Italian political risks because it’s “very hard” to depict scenarios in which Greece could default on its borrowings, according to Societe Generale SA.

That could help the securities outperform Italian ones provided potential bouts of risk aversion in the region continue to be centered on Rome, analysts at the bank said.

“There is long-term value in Greece, especially when we get over the threats of risk aversion just now,” Societe Generale strategists Yvan Mamaletand Ciaran O’Hagan wrote in a note to clients. “GGB spreads should narrow relative to BTPs if the origin of the disturbance is in Italy.”

Greece is set to exit its third bailout package this month and may announce this year its program for tapping the markets in 2019. Currently, investors are only able to buy the country’s bonds at a syndication, which makes it challenging to exit the market should an external shock — such as the recent slide in Turkey’s lira — jolt global markets.

Bank of Greece data show that turnover on the electronic secondary securities market, or HDAT, totaled 139 million euros ($157 million) this month through Aug. 10. That compares with 561 million euros in the whole of July and a peak of 136 billion euros in September 2004.

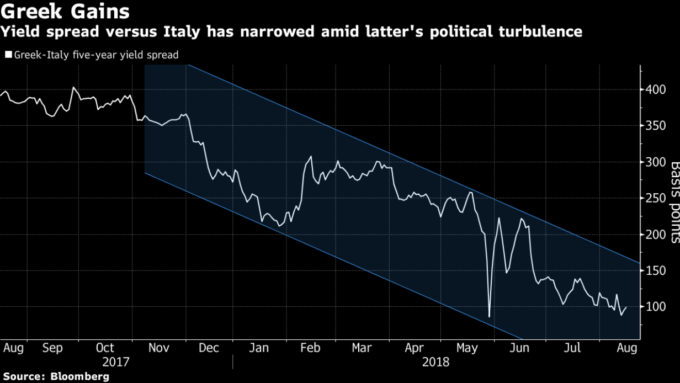

Still, the yield premiums on Greek bonds over so-called BTPs have narrowed through the turmoil that rocked Italy’s markets in recent months. The five-year spread is at 100 basis points, the lowest level since the financial crisis.