Apr

Apr

Apr

Greek enterprises reported higher sales and a significant increase in profitability in 2017, while positive signs are also evident in 2018, ICAP said in a survey based on a sample of 13,154 enterprises.

The survey said that accumulated turnover grew around 10 pct in 2017, while operating earnings rose around 17 pct compared with the previous year. Net pre-tax earnings totaled 4.67 billion euros in 2017, up 14 pct from 2016. ICAP said that 153 Greek-listed enterprises -excluding banks – recorded a 9.0 pct increase in turnover and a 25 pct rise in profits in the first half of 2018.

Nikitas Konstantellos, chairman and CEO of ICAP Group, commenting on the survey said that “after a long-term recession period, the Greek economy recorded a slight recovery in 2017, with the country’s GDP growing by 1.5 pct compared with the previous year. It is encouraging the fact that this trend continued in 2018 at a slightly increased rate. This development will have a positive effect on Greek business activity”.

Source: ANA-MPA

Apr

Early repayment of expensive IMF loans has been a longstanding ambition of the Greek government, as it seeks to bring down its debt refinancing costs. Talk of the plan comes as the country moved closer to fulfilling a first set of post-bailout commitments, which will likely allow for the disbursement of some 1 billion euros ($1.12 billion) in aid at a meeting of euro-area finance ministers on Friday.

Prime Minister Alexis Tsipras’s government hasn’t so far submitted any formal request to the IMF to make an early repayment, but the government is exploring such a step, according to two Greek officials, who spoke on condition of anonymity as the plans are not yet final.

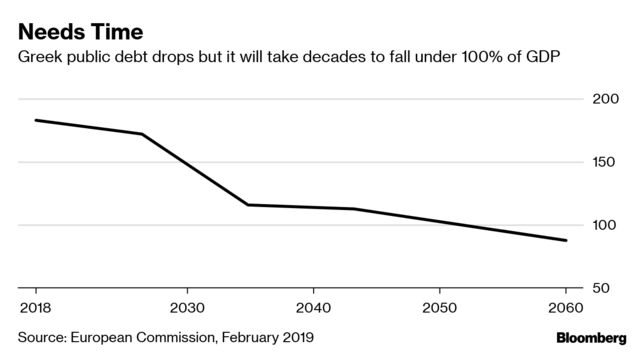

Greece and its creditors struck a landmark deal last summer to ease the repayment terms for part of the nation’s mountain of debt, which nonetheless still stands at around 180 percent of its gross domestic product. Repaying the IMF early would reduce Greece’s debt obligations for the coming years since part of these loans are more expensive than both the bailout funds it has received from the euro zone and even the country’s cost of new borrowing from the markets.

The move could also help boost Tsipras’ political capital ahead of a general election this year, as it will add to signs that the economy is stronger and that the country can start weaning itself off its creditors. This will also allow the premier to claim he has reduced the IMF’s exposure to Greece and thus reduced the need for its oversight.

Waiver Needed

The repayment will first require a green light from the euro area. That’s because, as creditors to Greece, other euro-area countries must waive their right to be paid back early by a proportional amount. This waiver has been granted in the past to former bailout countries such as Ireland and Portugal.

EU officials say Greece hasn’t so far made any official request to repay the IMF early. But even if it does, it is not a given that the euro zone will be on board.

That’s because some countries could be skeptical about whether the early repayment would be financially beneficial for Greece rather than just replacing official debt with still-pricey borrowing from the markets. As well as needing to show that the savings in debt servicing costs from this swap would be significant, Athens may also need to prove to its creditors that its plans for economic overhauls remain ambitious.

Countries such as Germany, which insisted on the IMF’s participation in the Greek rescue program, may hesitate to approve a step that will minimize the fund’s involvement, officials say. Such nations have in the past sought the IMF’s participation as a seal of credibility for the Greek bailout.

Read More: Germany Rejects Greek Plan to Repay IMF Early: Handelsblatt

What’s more, the government’s latest delays in fulfilling the conditions attached to its post-bailout review, including a prolonged spat over a household insolvency framework may spook creditors, who worry about its impact on the Greece’s troubled banks and fear it may be a harbinger of profligate behavior ahead of this year’s national elections.

Mar

27 Μάρτιου (ΑΠΕ-ΜΠΕ) — Μηδενίστηκε η εξάρτηση του ελληνικού τραπεζικού συστήματος από τον ELA – του μηχανισμού παροχής έκτακτης ενίσχυσης των τραπεζών σε ρευστότητα.

Η Attica Bank ήταν η τελευταία που είχε την ανάγκη κεφαλαίων από τον ELA και πλέον έχει απεξαρτηθεί και αυτή. Αξίζει να σημειωθεί, σύμφωνα με τραπεζικές πηγές, πως την 1η Ιανουαρίου 2012 η ανάγκη του συνόλου των ελληνικών τραπεζών από τα κεφάλαια του ELA ήταν ύψους 17,43 δισ. ευρώ, ενώ τον Αύγουστο του 2018, όταν η Ελλάδα εξήλθε του προγράμματος των δανειστών, ο ELA ήταν ύψους 4,49 δισ. ευρώ. Τραπεζικές πηγές μιλώντας στο ΑΠΕ – ΜΠΕ τόνιζαν πως ο μηδενισμός του ELA δείχνει ότι το ελληνικό τραπεζικό σύστημα επανέρχεται στην κανονικότητα τους.

Πηγή: ΑΠΕ-ΜΠΕ

Mar

Bloomberg: Η θριαμβευτική επιστροφή της Ελλάδας στην πρωτογενή αγορά ομολόγων της Ευρώπης με την έκδοση του δεκαετούς ομολόγου, μόλις λίγες εβδομάδες μετά την έκδοση του πενταετούς ομολόγου, θέτει ορόσημο στην ανάκαμψη της χώρας από την οικονομική κρίση.

Η έκδοσή του ελληνικού δεκαετούς ομολόγου, προσέλκυσε το μεγαλύτερο βιβλίο εντολών της εβδομάδας τόσο από πλευράς όγκου όσο και από πλευράς υπερκάλυψης, επιτρέποντας στον ΟΔΔΗΧ να κόψει 22,5 μονάδες βάσης από την αρχική τιμή.

Δείτε τους παρακάτω πίνακες από τα διαθέσιμα εβδομαδιαία δεδομένα στατιστικά των βιβλίων:

Corporates

| Issuer | Deal Size | Orderbook | Subscription | Note |

|---|---|---|---|---|

| Medtronic | EU7.00b | EU30b | 4.29 | 6-part |

| Vinci | GBP400m | GBP1.45b | 3.63 | |

| Telefonica Emisiones | EU1.00b | EU3.50b | 3.50 | |

| Heathrow Funding | EU650m | EU2.25b | 3.46 | |

| Vinci | GBP400m | GBP1.35b | 3.38 | |

| Nokia | EU750m | EU2.50b | 3.33 | |

| Anglo American Capital | EU500m | EU1.60b | 3.20 | |

| Anglo American Capital | GBP300m | GBP700m | 2.33 | |

| Telefonica Europe (Hybrid) | EU1.30b | EU2.80b | 2.15 | |

| Cie Saint Gobain | EU1.50b | EU2.90b | 1.93 | 2-part |

FIG

| Issuer | Deal Size | Orderbook | Subscription |

|---|---|---|---|

| CYBG (AT1) | GBP250m | GBP1.15b | 4.60 |

| Jyske Realkredit | EU500m | EU2.00b | 4.00 |

| Bank of China, Paris | EU500m | EU1.75b | 3.50 |

| BFCM (SNP) | EU1.00b | EU3.25b | 3.25 |

| Erste Group Bank (AT1) | EU500m | EU1.60b | 3.20 |

| Credit Mutuel Arkea (Tier 2) | EU750m | EU1.80b | 2.40 |

| AMP Group Finance Services | $300m | $600m | 2.00 |

| Mortgage Society Finland | EU300m | EU560m | 1.87 |

| Stadshypotek | EU1.25b | EU2.10b | 1.68 |

| Sagax | EU300m | EU500m | 1.67 |

| ASB Finance | EU500m | EU700m | 1.40 |

| Deutsche Pfandbriefbank (Sr Pref) | EU250m | EU300m | 1.20 |

SSA

| Issuer | Deal Size | Orderbook | Subscription |

|---|---|---|---|

| Hellenic Republic | EU2.50b | EU11.80b | 4.72 |

| State of North Rhine Westphalia 15Y (Sustainable) | EU2.25b | EU7.80b | 3.47 |

| State of North Rhine Westphalia 7Y | EU2.50b | EU6.10bn | 2.44 |

| EIB (SONIA) | GBP500m | GBP1.20b | 2.40 |

| L-Bank | $500m | $600m | 1.20 |

| Asian Development Bank | GBP700m | GBP765m | 1.09 |

| FMS Wertmanagement | EU500m | EU500m | 1.00 |

Mar

- The deal attracted the week’s largest orderbook by both volume and subscription level, allowing the sovereign to cut 22.5bps from the initial price talk

- See tables below for available weekly bookstats data

Corporates

| Issuer | Deal Size | Orderbook | Subscription | Note |

|---|---|---|---|---|

| Medtronic | EU7.00b | EU30b | 4.29 | 6-part |

| Vinci | GBP400m | GBP1.45b | 3.63 | |

| Telefonica Emisiones | EU1.00b | EU3.50b | 3.50 | |

| Heathrow Funding | EU650m | EU2.25b | 3.46 | |

| Vinci | GBP400m | GBP1.35b | 3.38 | |

| Nokia | EU750m | EU2.50b | 3.33 | |

| Anglo American Capital | EU500m | EU1.60b | 3.20 | |

| Anglo American Capital | GBP300m | GBP700m | 2.33 | |

| Telefonica Europe (Hybrid) | EU1.30b | EU2.80b | 2.15 | |

| Cie Saint Gobain | EU1.50b | EU2.90b | 1.93 | 2-part |

FIG

| Issuer | Deal Size | Orderbook | Subscription |

|---|---|---|---|

| CYBG (AT1) | GBP250m | GBP1.15b | 4.60 |

| Jyske Realkredit | EU500m | EU2.00b | 4.00 |

| Bank of China, Paris | EU500m | EU1.75b | 3.50 |

| BFCM (SNP) | EU1.00b | EU3.25b | 3.25 |

| Erste Group Bank (AT1) | EU500m | EU1.60b | 3.20 |

| Credit Mutuel Arkea (Tier 2) | EU750m | EU1.80b | 2.40 |

| AMP Group Finance Services | $300m | $600m | 2.00 |

| Mortgage Society Finland | EU300m | EU560m | 1.87 |

| Stadshypotek | EU1.25b | EU2.10b | 1.68 |

| Sagax | EU300m | EU500m | 1.67 |

| ASB Finance | EU500m | EU700m | 1.40 |

| Deutsche Pfandbriefbank (Sr Pref) | EU250m | EU300m | 1.20 |

SSA

| Issuer | Deal Size | Orderbook | Subscription |

|---|---|---|---|

| Hellenic Republic | EU2.50b | EU11.80b | 4.72 |

| State of North Rhine Westphalia 15Y (Sustainable) | EU2.25b | EU7.80b | 3.47 |

| State of North Rhine Westphalia 7Y | EU2.50b | EU6.10bn | 2.44 |

| EIB (SONIA) | GBP500m | GBP1.20b | 2.40 |

| L-Bank | $500m | $600m | 1.20 |

| Asian Development Bank | GBP700m | GBP765m | 1.09 |

| FMS Wertmanagement | EU500m | EU500m | 1.00 |

Mar

The country plans to open the books on a syndicated offering of at least 2 billion euros ($2.3 billion) of bonds after announcing Monday it hired banks for the sale, according to a person familiar with the matter, who asked not to be named because the details aren’t final yet.

Prime Minister Alexis Tsipras, facing a general election this year that polls show he’s set to lose, has pointed to bond sales as proof the country has turned a corner after its economy shrank by a quarter during the crisis.

After ending its bailout program last summer, Greece tapped the market for 2.5 billion euros of five-year bonds in January. The success of that sale, the country’s first in almost a year, paved the way for the 10-year issue.

Following the Tuesday sale, Greece will be almost two-thirds of the way to meeting its 2019 goal of raising as much as 7 billion euros this year.

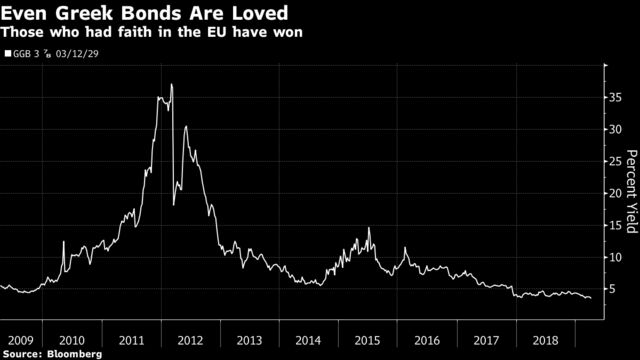

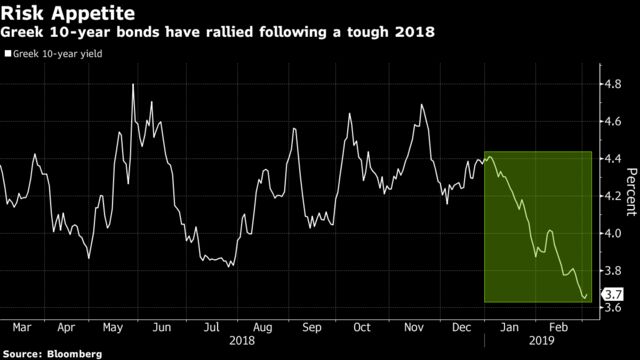

Greek stocks and bonds have rallied this year, with the Athens Stock Exchange up more than 15 percent and the yield on benchmark 10-year government bonds down below 3.7 percent. The yield peaked at about 37 percent at the height of the debt crisis in 2012, just before Greece defaulted on its debt to private-sector creditors.

The country last sold 10-year bonds in March 2010, with a 6.25 percent coupon, as the country was in the eye of a storm after a new government revealed that its predecessor had hidden the true size of its budget deficit.

While it issued similar maturity debt in 2017, that was part of an exchange for bonds that were part of its debt restructuring.

Greece’s travails opened a new chapter in the global financial crisis, and two months later it entered the first of three bailouts from the euro area and International Monetary Fund.

For other euro-area countries like Ireland and Portugal that followed Greece in having to take bailouts, issuing 10-year debt was seen as a key staging post in the journey to regaining economic sovereignty.

Moody’s Investors Service on Friday raisedGreece’s sovereign credit rating two steps to B1 from B3. Although that’s still four levels below investment grade, it gave a fresh boost to the government’s bond-selling plan following European Commission criticism that the government was dragging its feet on key economic reforms.

Mar

The country’s long-term foreign currencydebt was upgraded to B1 with a stable outlook from B3, Moody’s said in a statement on Friday. The new ranking remains four levels below investment grade.

“The ongoing reform effort is slowly starting to bear fruit in the economy,” Moody’s said. “While progress has been halting at times, with targets delayed or missed, the reform momentum appears to be increasingly entrenched, with good prospects for further progress and low risk of reversal.”

Greece exited its international bailout last summer, though foot-dragging on some key economic reforms is raising creditor concern and putting at risk a planned debt relief measure this month. The government is planning to tap the markets once again, after a successful sale of five-year bonds in January, most probably with a new 10-year bond this month, given that appetite for Greek risk among investors remains strong.

The country’s stocks and bonds have risen this year, with the Athens Stock Exchange index up about 16 percent since the start of 2019. The yield on benchmark 10-year bonds is now below 3.7 percent, compared with a peak of about 37 percent at the height of the debt crisis in 2012, when Greece defaulted on its debt to private-sector creditors.

“The most politically painful measures have already been enacted, with the economy finally showing signs of recovery, reducing the incentives for any future government to jeopardize the hard-won gains,” the rating company said. “The stable outlook balances the relatively low risk of policy or fiscal reversal against the limited upside to Greece’s credit profile.”

The upgrade is the first time in more than a year that Moody’s has changed Greece’s rating. Fitch Ratings upgraded the country to BB- in August, while S&P Global Ratings rates the country B+. Each is below the junk threshold.

Feb

D-Link and Microsoft Collaborate to Deliver Smart CitySolutions at MWC 2019

PR Newswire

BARCELONA, Spain, Feb. 25, 2019

D-Link incorporates Microsoft Vision AI technology into its smart city solutions portfolio to transform cities and businesses in the age of digitalization

BARCELONA, Spain, Feb. 25, 2019 /PRNewswire/ — Today at MWC 2019, D-Link announced that they are collaborating with Microsoft to provide tailor-made intelligent edge solutions for both businesses and cities. Today, cities and businesses of all kinds are embracing digital transformation and deploying IoT solutions so that all types of environments and infrastructure — banks, hospitals, offices, parks, intersections, parking lots etc. can become smarter, safer and more efficient. Advances in technologies including 5G, Cloud services, AI and Edge Computing provide the foundation for this digital transformation. Edge computing technologies and 5G are enabling better connectivity, new services and decreased latency, while machine learning and artificial intelligence enable real-time analytics so users can make informed decisions.

D-Link’s next generation smart city solutions leverage the Azure Machine Learning platform, AZURE media services and Azure IoT Edge to deliver seamless machine learning, modeling, conversion, deployment, and video analytics in one coherent loop. D-Link utilized the Microsoft Vision AI developer kit to enable features including facial and object recognition in their surveillance cameras, so cities and businesses can improve public and private safety, traffic management, pollution control, smart retail, and smart parking.

As a result of this collaboration, we will be able to deliver highly customized computer vision solutions that meet the specific needs of customers across industries and in different types of cities. These solutions will get smarter over time thanks to ongoing refinements enabled by Azure Machine Learning.

“D-Link is thrilled to work with Microsoft on our next-generation edge AI solutions that will revolutionize the digital future of cities and businesses with intelligent connectivity,” said D-Link President Steve Lin.

“Infusing vision AI into devices, like IP cameras, opens up more use cases by enabling data processing in real time without high-powered machines or continuous network connections,” said Rodney Clark, Vice President, IoT at Microsoft. “We are excited to work with D-Link to deliver innovative edge solutions with cognitive capability that empower businesses and cities to make smarter decisions.”