(Bloomberg Intelligence) — The malaise surrounding EU banks, with limited catalysts and growing macro fears, received little cheer at 3Q. HSBC, Barclays, ING, SEB and StanChart were among our preferred 3Q reports, as BNP, Nordea, UBI and Metro continue to struggle. Revenue expectations remain flat in aggregate, with further provision cuts likely. The capital and payout outlook is also largely unchanged.

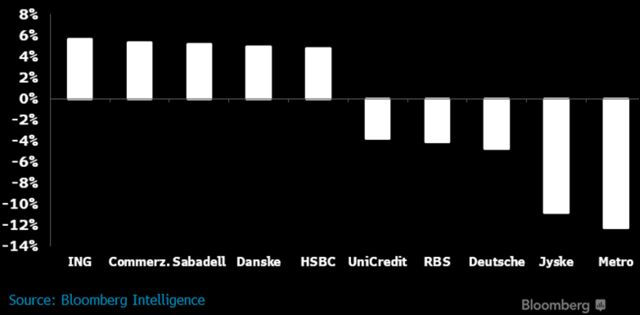

The average share price move of the 40-plus European banks on the trading day after they released 3Q results was 0.1%, which masks a very wide spread in performance. Metro Bank fell the most (12%), followed by Jyske (11%), Deutsche (5%) and RBS (4%). The biggest gainers were ING (6%) and HSBC (5%), which posted strong results. Commerzbank, Sabadell and Danske also bounced 5%, though we are less sanguine about the quality of their results. Barclays, Standard Chartered and Intesa all delivered positive surprises and outlooks, we feel, while Nordea, UBI and BNP’s results and commentary — albeit pre-empted by weak share price performance — also disappointed.

Expectations for average net interest income and total revenue growth in 2019 and 2020 have been marginally trimmed since mid-year, but are up 0.3% since 3Q earnings. UBS, Barclays, BCP and HSBC have received the largest post-3Q upgrades on net interest income. Average top-line growth is now expected to accelerate from 2% in 2019 to 3% in 2020. Fee growth and interest income growth are expected to be roughly even. HSBC’s return to growth is now baked into 6% expectations that have held steady. DNB and Erste lead expectations, even as consensus continues to moderate for both.

Consecutive good quarterly reports have led to Barclays revenue upgrades, putting it among the top-6 large cap banks on growth. ABN Amro, Natixis, Banco BPM, Nordea and RBS are the main banks expected to report small (1-3%) revenue contractions in 2019.

Contributing Analysts Philip Richards (Banks)

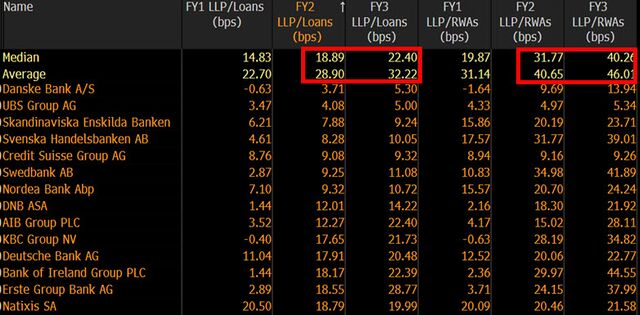

The median provision charge for EU banks (including Nordics) is expected to rise from 20 bps (as a percentage of RWAs) in 2018 to 32 bps in 2019, and 40 bps in 2020. We estimate that 2019 consensus charges may tick lower in early 2019, though acknowledge that IFRS 9 may bring some negative surprises, likely back-ended to late-2019. The majority of 2019 expectations have been revised lower since 3Q results, with RBS, Allied Irish Banks, HSBC, Standard Chartered and the French banks taking the largest cuts.

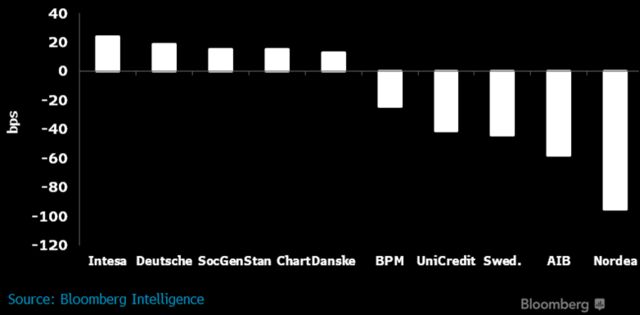

Average CET1 expectations for 2019 have fallen 6 bps since the start of 3Q earnings, with Nordea (95 bps), Allied Irish Banks (58 bps), Swedbank (44 bps), UniCredit (41 bps) and Banco BPM (24 bps) leading the fall. Conversely, Intesa (24 bps), Deutsche Bank (19 bps), SocGen and Standard Chartered (both 15 bps) and Danske (13 bps) surprised positively, leading to consensus upgrades. Swedish banks will see further cuts to consensus CET1 as 25% risk-weighting is applied to their domestic mortgage books. Average expected payout ratios remain flat for 2019 and 2020, at 50% and 55%, respectively.

Natixis (107% and a special dividend of 1.5 billion euros likely in early 2019), Nordea (93%), Intesa (80%), SEB and Handelsbanken (75% each) lead the payout ranking for 2019. ABN’s 3Q update on Basel IV impacts cut payout expectations.

Contributing Analysts Tomasz Noetzel (Banks)

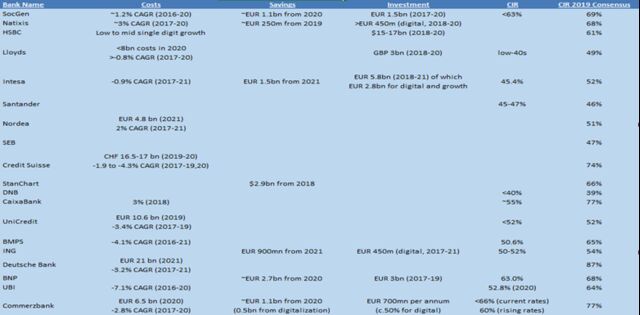

Consensus estimates for the European banks suggest that average EPS growth in 2020 could rise to more than 10%, with recovery stories including Deutsche Bank, Commerzbank, Banco BPM, and RBS leading the charge. We believe that revenue pressures will lead to top-line disappointments, leaving overdelivery on cost control as the major determinant of share prices into 2019. Further, we would expect another round of bloodletting within the IB space as MiFID II bites and margin slippage continues. Lower provisions will offset some of the revenue weakness, as will new cost cutting plans.

The multi-billion dollar investment programs most banks are currently pursuing, as well as weak revenue, suggest to us that the majority of European banks will miss their respective cost-income targets. Consensus shows that DNB, Santander (where a new plan is due) and UniCredit are three of the very limited number of lenders expected to deliver on cost-income ratio targets, which we believe is true. Lloyds’ top-line momentum, with a material pickup in non-interest income needed, suggests that despite being one of the most efficient banks in Europe, it will also miss its efficiency goal.

Comments ( 0 )