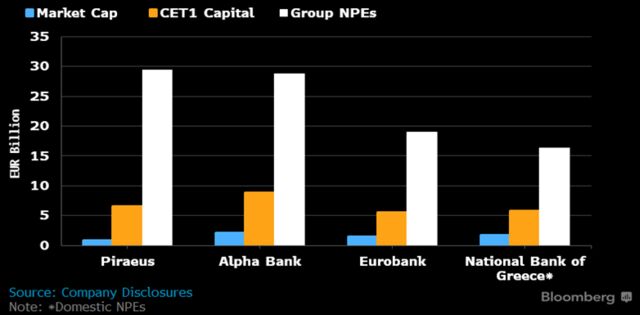

(Bloomberg Intelligence) — The Single Supervisory Mechanism is between a rock and a hard place as it starts discussions with Greece’s banks over new medium-term plans, NPE and CET1 targets. The country’s four main banks, whose rehab is far from over, have total nonperforming exposure of $100 billion vs. a total market cap of about $7 billion and coverage levels similar to Italy’s weakest lenders.

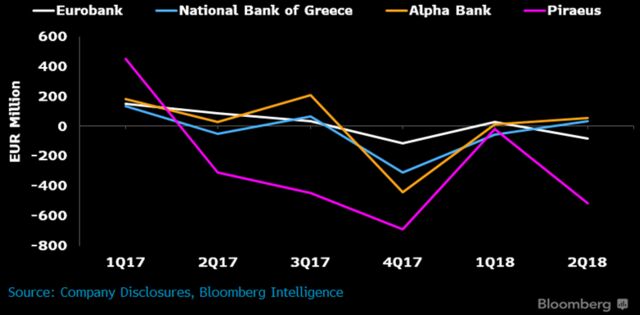

While it’s clear to all onlookers that Piraeus Bank, and peers, remain undercapitalized vs. their bad-debt mountains, we believe that the ECB will struggle to pull the trigger forcing capital raises. A Bloomberg News report suggests that adverse market conditions may force the ECB to give Piraeus more time to raise about 500 million euros of Tier 2 bonds. Given, we believe, virtually zero chance of a material equity capital increase, we would expect any Tier 2 raise to come at a mid-teens yield, if at all.

Bank of Cyprus raised 220 million euros of contingent convertible debt with a fixed coupon of 12.5% in August. One of the issues facing Greek banks issuing AT1 debt will be the creation of viable distributable reserves from which the coupon can be paid.

EFG Eurobank — arguably one of the stronger Greek banks with a profitable and material non-domestic business — shows how expensive it could be for a weaker domestically focused peer to issue capital. Its Tier 2 subordinated note, 950 million euros of which was placed with a 6.41% coupon in January, is yielding just shy of 11%, with the bond trading at 76 cents in the euro. Eurobank’s fully-loaded CET1 ratio is almost 1.5 percentage points higher than that of Piraeus and, we believe, any issuance from Piraeus would need to be priced in the mid-teens range.

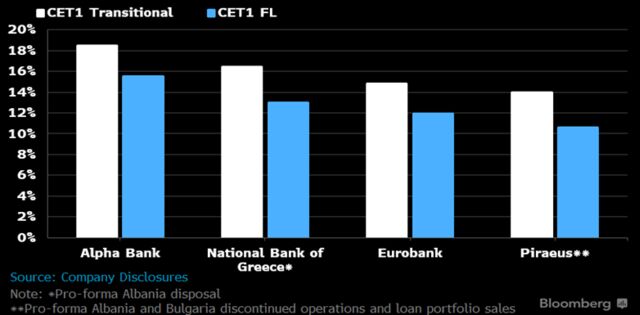

Piraeus bank remains the poster child for bad debt cleanup, with 28.5 billion euros of nonperforming exposures at 1H dwarfing less than 5 billion euros of fully-phased in CET1 capital (6.6 billion euros transitional). The approach taken to CET1 calculation, whether transitional — which the regulator will consider — or fully-loaded, which is a default for many investors, makes a significant difference. IFRS 9 and deferred tax assets — and the treatment thereof — are also significant deltas for each of the banks.

For Eurobank, the impact of transition to IFRS9 represents 250 bps of CET1 at 1H, effectively the difference between an 11.9% fully loaded ratio and 14.4% transitional. For Piraeus, the impact was increased 25% to 2 billion euros at 1H, highlighting the enormous sensitivity to accounting approach. Last reviewed by Jonathan Tyce on 09/28/18, original publish:

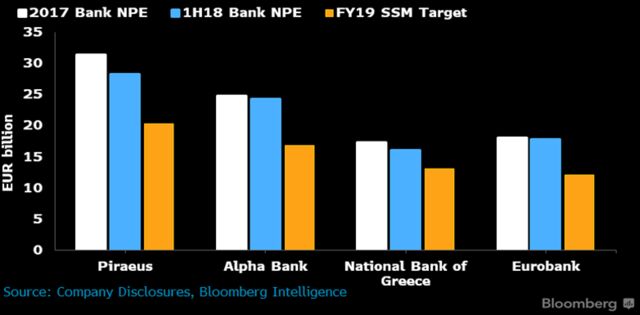

The elephants in the room that are deterring confidence in Greek banks remain centered on vast non-performing exposures (NPEs), the purchase of foreclosed property at auctions, and growing periphery fears. The four largest Greek banks had aggregate group NPEs of nearly 94 billion euros as of 2Q, more than 90% of which are domestic Greek exposures. We expect that new NPE targets (to be agreed with the ECB and announced for 2020/21) will imply a halving or more of these NPEs, with a little more than half predicated on sales and securitizations.

One key unknown remains the depth and appetite for securitized-mortgage (secured and unsecured) and SME NPL portfolios, as well as further sales. New targets will likely imply collective capacity for about 25 billion euros of transactions through 2021, a key risk. Last reviewed by Jonathan Tyce on 09/28/18, original publish:

The rate of increase in restructurings and foreclosures, combined with a fall in non-performing exposure inflows, are together critical drivers of how quickly Greek banks’ bad-debt problems are addressed. Should third-party appetite for portfolio sales and securitizations dry up, the SSM will expect banks to absorb higher losses and writedowns, testing the resilience of already-limited cash coverage and fully loaded common equity tier-1 bases.

National Bank of Greece said on its 2Q call that it understood that the target set by the SSM for 2021 would be “aggressive” and as such, inorganic measures would be critical. The ability of banks to absorb further provisions to write off unprovisioned portions of NPEs also explains the need for a greater cost focus, to bolster their pre-provision operating-profit cushions.

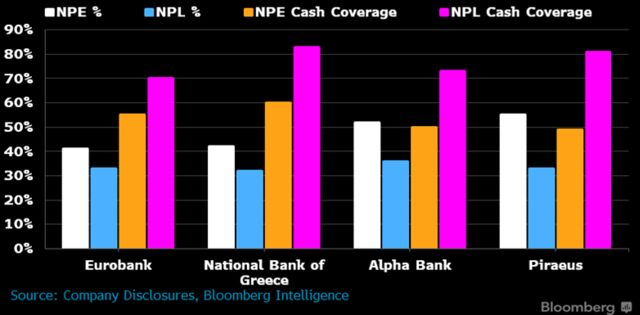

Cash coverage levels for the Greek banks ranged from 49% (Piraeus) to 60% (NBG) at 1H, with both Alpha and Eurobank within the low end of this range. This is in-line with Italy’s more beleaguered banks Banco BPM (51%), Carige (50%), Monte Paschi (56%) and CredEm (50%). Curing of these NPEs will continue to be driven by corporate and SME segments, we believe, while the impact of the growing number of auctions on consumer behavior could accelerate organic outflows of NPEs.

Business loans represent two-thirds of Piraeus’ NPEs, with mortgages a little more than 20%. For Eurobank, mortgages (one-third) exceed corporate (30%) NPEs. Mortgages are larger (almost 50%) than SME and corporate combined for National Bank of Greece.

The number of foreclosed property auctions has accelerated since moving online, with an 8,000-10,000 target for 2018 looking increasingly likely as the number of suspended auctions falls. From late 2008, Greek residential house prices fell an average of more than 40%, and now appear to have bottomed. In a practice not dissimilar to that followed by Spain’s banking system, and owing to the lack of buyers, Greek banks have been buying back 80% or more of these properties at auction.

Eurobank disclosed that it had bought 88% of 913 properties auctioned between January-July, and Alpha Bank some 80%. The practice will remain subject to skepticism, questioning whether it’s merely a means to reclassify a nonperforming exposure as a long-term asset. Minimum prices are set with reference to the property index and court discretion.

Comments ( 0 )