(Bloomberg Intelligence) — Greek banks remain hostage, to a large extent, to the fortune of the wider economy and the success and timing of sovereign capital raising and fiscal discipline in the nation. Beyond that, the tradeoff between running off high non-performing exposure while sustaining revenue is a difficult balancing act. Tourism and exports will determine growth in the critical corporate-loan space.

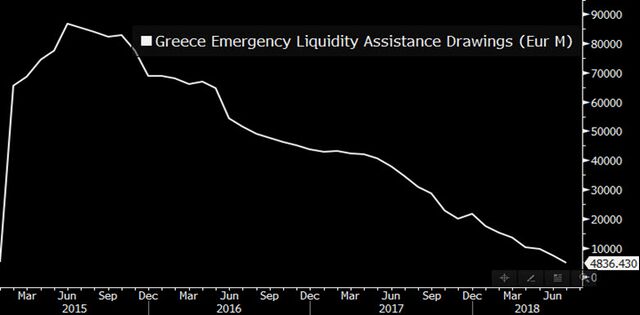

Greek banks’ reliance on the ECB’s emergency liquidity assistance program will fully end by early 2019, having fallen from a high of nearly 90 billion euros in mid-2015. The re-animation of the repo market, as well as inflows of about 1 billion euros a month back into the retail deposit market, suggest that the banks’ liquidity is robust. The banks’ thin capital bases, however, especially if harsh assumptions on cleanup of non-performing exposure (NPE) are applied, mean that liquidity comfort isn’t a given.

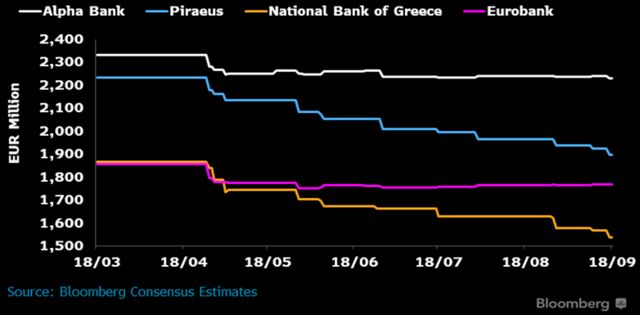

A key challenge for Greek banks is stemming the slide in revenue as loans fall into the non-performing category and the pool of assets falls with every sale, writeoff and impending securitization. New loan production, such as there is, exists in the corporate arena where National Bank has built up several billion euros of excess liquidity to close its underweight share. We believe there is scope for non-interest income revenue to surprise on the upside, but acknowledge that the difficult tradeoff for investors remains: The higher the rate of asset-quality clean up, the greater the short-term revenue impact.

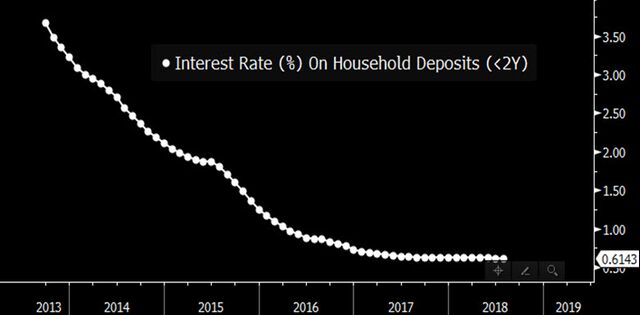

Two of the major drivers of Greek banks’ net interest margins in recent quarters have been the slide in retail funding costs and the exit from expensive ELA funding. Further relief from deposit-cost repricing is very limited, we believe, suggesting that new loan production and higher front-book corporate pricing will determine revenue direction. New-business rates are pricing 100-130 bps higher than the yield on existing stock. Increasing levels of eligible collateral that banks possess (as ratings improve and covered bond issuance grows) will also unlock access to cheap ECB funds, which should provide some net interest income relief.

Large non-performing exposures continue to impede lending capacity, and Greek banks need accelerated balance sheet cleanup to support the real economy. Tourism will be a key driver of credit demand; the World Travel & Tourism Council estimates that tourism’s total contribution to GDP was 19.7% in 2017 and will grow to 22.7% by 2028. Export-oriented businesses are another important sector, as they have held up better during the Greek crisis, supported by external demand; the share of exports relative to GDP has risen to 36% in 2Q vs. 19% in 2009, according to Eurostat. Gradual domestic recovery and falling unemployment should stimulate credit demand and boost banks’ willingness to lend.

The Greek economy should continue its gradual recovery , with modest GDP growth and further declines in unemployment likely. Real GDP growth of 1.4% in 2017 reversed two years of contraction in 2015 and 2016, with unemployment falling about 6% since 2013. A Bloomberg-compiled consensus points to cumulative GDP growth of 6% over the next three years, in line with the European Union average. A further 3% drop in the unemployment is projected by 2019, but that still leave Greece with the highest unemployment rate in Europe.

House prices have began a nascent recovery after a decade of decline, with prices of urban area dwellings growing by 1% year-on-year in 2Q according to the Bank of Greece. The impact of bank-run auctions and purchases will lead to some skepticism about any price recovery.

Comments ( 0 )