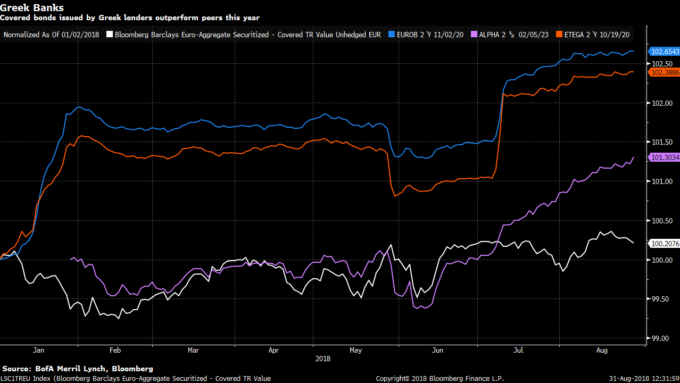

“At the moment we see good value in Greek covered bonds, which we’ve been invested in since October last year,” Henrik Stille, portfolio manager, said in an interview on Monday. “We still see some value there.”

Greece turned a page on the sovereign debt crisis that exploded eight years ago, exiting a bailout on Aug. 20. Earlier in the month, Fitch Ratings upgraded the country one step to BB- citing improved “general government debt sustainability” and noting that confidence in the banking sector is rising.

Nordea’s Danish fixed income and European covered bond team manages about 39 billion euros ($45 billion). Its European Covered Bond fund has returned 4.3 percent a year on average over the past five years, beating 90 percent of its peers, according to data compiled by Bloomberg.

It holds about 100 bonds including debt issued by National Bank Greece SA. Stille says it’s also still possible to find some “attractive opportunities” in Denmark and Sweden, as the Scandinavian markets aren’t trading as tight as their European counterparts.

“From time to time, we also see value in Denmark and Sweden,” he said. “But it’s not the overall market that is attractive. It’s more specific segments of these markets we like.”

Active Strategy

The fund doesn’t take any duration bets but has an active strategy based on relative value.

“The relative value between the markets can vary quite a lot in a year,” he said. “Especially between the markets in euro and the markets in the domestic Scandinavian currencies. It’s important to be active and move the exposure around.”

Tapering by the European Central Bank won’t have a big impact on covered bond spreads as the bank will keep reinvesting, Stille said.

“Many of the core European countries — like Germany, France, Netherlands and Scandinavia — there we think covered bonds are rather attractive versus government for example,” he said. “Even though spreads are a bit tight in absolute terms we don’t think that they are too expensive.”

Nordea’s low duration European covered bond strategy, which has a duration of one year compared with five years for the European Covered Bond fund, has experienced big inflows, passing 1 billion euros in assets after being launched in October last year.

“Investors don’t think that they’re getting compensated enough for taking risk in the financial markets at the moment,” he said. “It’s better to buy covered bonds that are the safest bonds you can invest in, because then you get an investment that is much safer if we run into financial turmoil.”

Comments ( 0 )