17 Απρίλιου (ΑΠΕ-ΜΠΕ) — Η Ευρωπαϊκή Επιτροπή είναι ανοιχτή να συζητήσει για το αφορολόγητο, όπως συνέβη και με τη μη περικοπή των συντάξεων: αυτό επισημαίνει σε συνέντευξή του στο Euro2day.gr ο αντιπρόεδρος της Κομισιόν και υψηλόβαθμο στέλεχος του Ευρωπαϊκού Λαϊκού Κόμματος, Βάλντις Ντομπρόβσκις.

Ερωτηθείς ειδικότερα για το θέμα, σημειώνει μεταξύ άλλων: «Η γενική μας άποψη για τα μέτρα αυτά ήταν ότι εάν υπάρχει δημοσιονομικός χώρος πέρα από την επίτευξη δημοσιονομικών στόχων, τότε είμαστε ανοιχτοί να συζητήσουμε πώς θα χρησιμοποιηθεί ο χώρος αυτός. Όπως θυμάστε, το ίδιο συνέβη και με τις περικοπές των συντάξεων», υπενθυμίζει και συνεχίζει: «Η Κομισιόν είναι ανοικτή και εάν υπάρχει δημοσιονομικός χώρος και (το αφορολόγητο εισόδημα) αποτελεί προτεραιότητα για την ελληνική κυβέρνηση, τότε θα το υποστηρίξουμε».

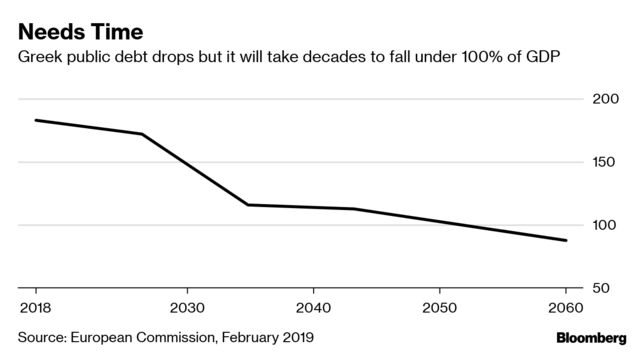

Ταυτοχρόνως ο Επίτροπος εμφανίζεται θετικός και στο θέμα της πρόωρης εξόφλησης των δανείων του ΔΝΤ: «Είμαστε ανοικτοί για αυτή τη λύση. Κατά μία έννοια, είναι σχετικά συνηθισμένη πρακτική στις χώρες που είχαν πρόγραμμα (…) Η Ελλάδα διαθέτει επί του παρόντος αρκετό απόθεμα σε κονδύλια για να αποπληρώσει τα δάνεια και έτσι να μειώσει τα επιτόκια. Η Επιτροπή υποστηρίζει αυτό το βήμα (…) Οι ελληνικές αρχές θα αποφασίσουν μαζί με το ΔΝΤ ποια είναι η καλύτερη πορεία», διευκρινίζει επιπλέον. Ενώ για τους στόχους πρωτογενών πλεονασμάτων επαναλαμβάνει τη θέση της Κομισιόν για τήρηση των συμφωνιών.

Σε ένα γενικότερο σχόλιό του για την πορεία της ελληνικής οικονομίας, ο Β. Ντομπρόβσκις σημειώνει εξάλλου, «η Ελλάδα εκπληρώνει τις δεσμεύσεις της στη μετά πρόγραμμα εποχή και υπερβαίνει τους στόχους του πρωτογενούς πλεονάσματος, όπως και τα προηγούμενα χρόνια. Η Ελλάδα εφαρμόζει μια φιλόδοξη ατζέντα και πρέπει να αναγνωριστεί η προσπάθειά της». Ενώ αναφέρεται και στις «ανησυχίες» που έχει η Επιτροπή σε κάποια θέματα, φέρνοντας το παράδειγμα του νέου νόμου Κατσέλη και πώς αυτός δεν πρέπει να οδηγήσει «σε περαιτέρω χαλάρωση της πειθαρχίας αποπληρωμής των δανείων».

Όμως, ο αντιπρόεδρος της Ευρωπαϊκής Επιτροπής δίνει και το στίγμα της επόμενης μέρας λέγοντας: «Η Ελλάδα επιστρέφει στον κύκλο του Ευρωπαϊκού Εξαμήνου. Το επόμενο σημείο θα είναι οι αρχές Ιουνίου, με το ανοιξιάτικο πακέτο. Μέχρι τότε, θα χρειαστεί να αξιολογήσουμε τα μεσοπρόθεσμα δημοσιονομικά σχέδια της Ελλάδας και το επόμενο βήμα είναι η δέσμη του φθινοπώρου, όπου η Ελλάδα θα παρουσιάσει το δημοσιονομικό σχέδιο για το 2020».