A bill that’s nearing the finish line in Brussels would soften the capital hit banks usually face when they sell non-performing loans at a loss. That could give a boost to Italian lenders, which are sitting on the EU’s biggest pile of soured debt — 174 billion euros($196 billion) — that’s often difficult to unload.

“This should make it easier for banks to clean up their balance sheets from bad assets without unduly impairing their lending capacity,” according to a Nov. 27 document seen by Bloomberg. The document lays out out a proposed compromise on the legislation reached by officials from the European Parliament and the Austrian government, which is leading work on the bill on behalf of the EU’s 28 member states.

The proposal is the latest sign that EU policy makers are easing new capital and liquidity rules in response to pleas from the bloc’s banks, which are struggling to boost profits after a long period of low interest rates and stiff competition from foreign rivals. The new treatment of “massive disposals” of bad loans is part of a broad overhaul of EU banking laws that has been grinding along for two years.

Asset Risk

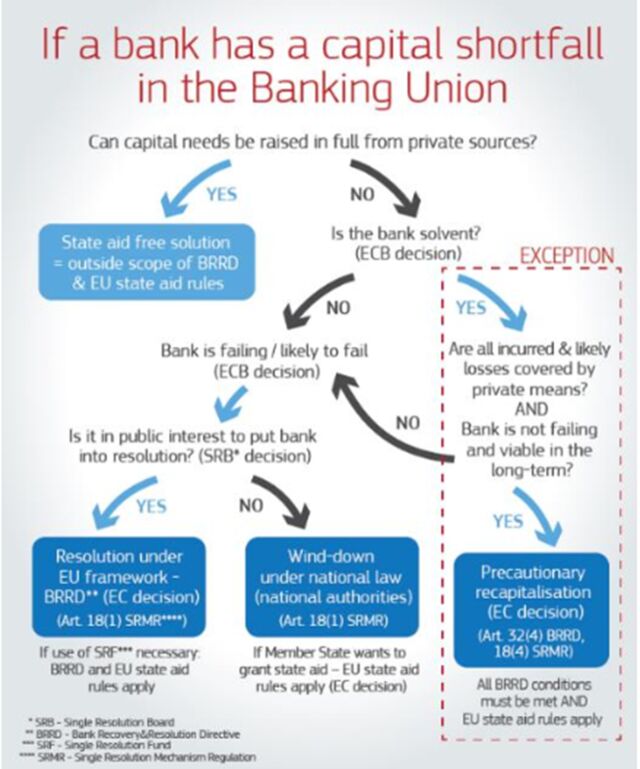

Under current rules, a bank must adjust the statistical models it uses to measure asset risk when it sells a chunk of bad loans at a steeper loss than foreseen by the models. Those adjustments can leave a bank needing more capital. The new rule would give banks options to prevent such knock-on effects when they sell large soured-debt portfolios at a loss.

The new measure would apply to sales after Nov. 23, 2016, and would expire three years after the rules come into force, according to the document. To qualify, a bank would have to sell more than 20 percent of its soured debt under the plan.

EU finance ministers still have to sign off on the package, and will discuss it when they next meet on Dec. 4. A spokesman for Austria’s presidency of the Council of the European Union declined to comment.

Opponents of the new rule include Daniele Nouy, the outgoing head of the ECB’s bank supervision arm, who has argued that it would “kill the credibility” of European lenders’ risk models compared to their peers in other regions of the world.