Apr

Apr

Apr

Greek enterprises reported higher sales and a significant increase in profitability in 2017, while positive signs are also evident in 2018, ICAP said in a survey based on a sample of 13,154 enterprises.

The survey said that accumulated turnover grew around 10 pct in 2017, while operating earnings rose around 17 pct compared with the previous year. Net pre-tax earnings totaled 4.67 billion euros in 2017, up 14 pct from 2016. ICAP said that 153 Greek-listed enterprises -excluding banks – recorded a 9.0 pct increase in turnover and a 25 pct rise in profits in the first half of 2018.

Nikitas Konstantellos, chairman and CEO of ICAP Group, commenting on the survey said that “after a long-term recession period, the Greek economy recorded a slight recovery in 2017, with the country’s GDP growing by 1.5 pct compared with the previous year. It is encouraging the fact that this trend continued in 2018 at a slightly increased rate. This development will have a positive effect on Greek business activity”.

Source: ANA-MPA

Apr

Early repayment of expensive IMF loans has been a longstanding ambition of the Greek government, as it seeks to bring down its debt refinancing costs. Talk of the plan comes as the country moved closer to fulfilling a first set of post-bailout commitments, which will likely allow for the disbursement of some 1 billion euros ($1.12 billion) in aid at a meeting of euro-area finance ministers on Friday.

Prime Minister Alexis Tsipras’s government hasn’t so far submitted any formal request to the IMF to make an early repayment, but the government is exploring such a step, according to two Greek officials, who spoke on condition of anonymity as the plans are not yet final.

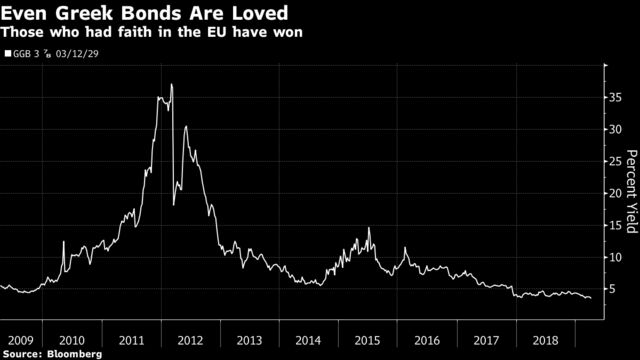

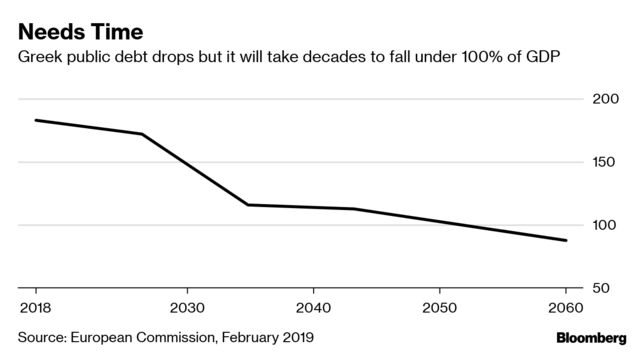

Greece and its creditors struck a landmark deal last summer to ease the repayment terms for part of the nation’s mountain of debt, which nonetheless still stands at around 180 percent of its gross domestic product. Repaying the IMF early would reduce Greece’s debt obligations for the coming years since part of these loans are more expensive than both the bailout funds it has received from the euro zone and even the country’s cost of new borrowing from the markets.

The move could also help boost Tsipras’ political capital ahead of a general election this year, as it will add to signs that the economy is stronger and that the country can start weaning itself off its creditors. This will also allow the premier to claim he has reduced the IMF’s exposure to Greece and thus reduced the need for its oversight.

Waiver Needed

The repayment will first require a green light from the euro area. That’s because, as creditors to Greece, other euro-area countries must waive their right to be paid back early by a proportional amount. This waiver has been granted in the past to former bailout countries such as Ireland and Portugal.

EU officials say Greece hasn’t so far made any official request to repay the IMF early. But even if it does, it is not a given that the euro zone will be on board.

That’s because some countries could be skeptical about whether the early repayment would be financially beneficial for Greece rather than just replacing official debt with still-pricey borrowing from the markets. As well as needing to show that the savings in debt servicing costs from this swap would be significant, Athens may also need to prove to its creditors that its plans for economic overhauls remain ambitious.

Countries such as Germany, which insisted on the IMF’s participation in the Greek rescue program, may hesitate to approve a step that will minimize the fund’s involvement, officials say. Such nations have in the past sought the IMF’s participation as a seal of credibility for the Greek bailout.

Read More: Germany Rejects Greek Plan to Repay IMF Early: Handelsblatt

What’s more, the government’s latest delays in fulfilling the conditions attached to its post-bailout review, including a prolonged spat over a household insolvency framework may spook creditors, who worry about its impact on the Greece’s troubled banks and fear it may be a harbinger of profligate behavior ahead of this year’s national elections.